Al-Arabia – Hossein Raqfar, an economy expert in Iran, has acknowledged the drastic financial situation facing the regime. Calculations are showing difficult periods ahead even despite what seems, at surface at least, a rebounding currency following the Iranian currency – the rial – plunging to 190,000 against the US dollar.

By Heshmat Alavi

While the dollar is claimed to sell at around 105,000 rials as we speak, experts are saying even if the rates rise to the regime’s official 42,000 rial the country would be facing deep and widespread recession.

Numerous production units will close down, leading to a significant surge in unemployment. Such developments raise concerns of more people pouring into the streets and a repeat of the Dec 2017 / Jan 2018 uprising.

Such undeniable realities on the ground in Iran leave the regime no choice but to engineer an artificial currency gain, aiming to prevent various imbalances and instabilities, economically, socially and even politically.

Saving face

The Iranian regime is the main element behind all of this country’s economic woes, including the currency crisis. There are a variety of political and social reservations taken into consideration, in line with the old saying of “Ask much to get little.”

The Iranian regime and its array of apologists/lobbyists abroad claim prices in Iran are skyrocketing due to foreign pressures and sanctions. With the currency rates rising artificially, the same voices claim these numbers are dropping due to their management.

These political and psychological schemes are targeting public opinion and seeking to calm a highly restive and potentially uprising society. A staunch reminder is the fact that the rial is hovering at rates three times that of ten months ago. Considering the various aspects in play effecting Iran’s currency rates, the economy is on path to a complete bankruptcy.

“Our equations show Iran’s economy will go bankrupt even with the U.S. dollar trading at 80,000 rials. Huge expenses will be placed on the shoulders of the country’s production lines and families will lose their purchasing powers at unprecedented scales. If rates remain above the 80,000 rial mark, the situation will be even worse,” Raqfar added in his remarks published in Iranian media.

Iranians shop in a supermarket in north Tehran on April 29, 2015. (File photo: AP)

Iranians shop in a supermarket in north Tehran on April 29, 2015. (File photo: AP)

Skyrocketing inflation

One of the regime’s main goals in raising the currency rates was to compensate for the government’s budget deficit and other such shortfalls in Iran’s banking system. This goal was never met, neither for the government’s concerns nor the banking system.

Fueling woes are skyrocketing prices across the board and with this ongoing trend, the regime’s experts are forecasting a rise of official inflation rates to 80 and even 100 percent. This will have drastic consequences for those making the calls in Tehran.

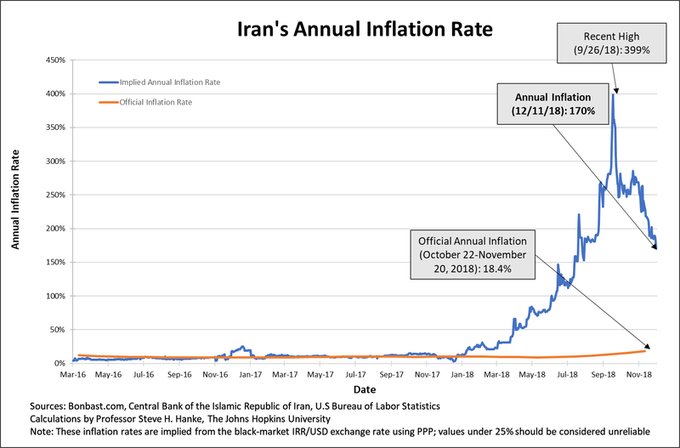

According to Professor Steve Hanke of Johns Hopkins University, Iran’s actual inflation rate the regime refuses to officially report stands at 170.5 percent.

These price hikes are witnessed in government goods and services, including the recent turmoil seen in increasing prices of airplane tickets. The Iranian regime actually profited from this dilemma, seeking to gain more currency to pay for government debts, including to the banks and especially private banks.

Speaking of banks, Ruhollah Khodarahmi, head of the Iranian regime’s Bank Keshavarzi (Agriculture), acknowledged the closing of 40 bank branches since late March with the goal of decreasing unnecessary expenses. In his interview with the regime’s officials IRNA news agency, this bank chief signaled the closing of another 50 further branches by March 2019.

Rest assured the actual numbers depict a far more drastic image and these remarks portray merely a tip of the iceberg for the economic dilemma engulfing the Iranian regime.

Banking system down

Iran’s banking system is literally on life support, with money provided by the regime and out of ordinary people’s pockets.

The banks are in no position to provide any support for production units, as they continue to be heavily dependent on the Central Bank and the government. Many of the country’s banks will shutdown without loans from the Central Bank.

The situation at hand for Iran’s economy is very serious and it is safe to say a soon-to-be-witnessed domino effect is prone to destroy production, ultimately leading to the crumbling of the entire economy.

To compensate a portion of their bankruptcy, the banks are charging 30 to 33 percent interest rates on production units, all with the Majlis (parliament) looking the other way. The Iranian regime’s so-called legislative body is under the control of the powerful and rich few in Iran.

As the banks continue their fraud and corrupt practices. Forecasts indicate more production lines will shut down in the months ahead and a new wave of unemployment will spread across the country. Production line owners are literally praying for a turn of events. With no positive development in sight, most of these units have been forced to shut down.

For the ruling regime in Iran this is a recipe for disaster, reminding Tehran about the very sparks fueling the late December 2017 uprising.

As we speak, the Iranian regime is going the distance to save the banking system by further plundering the Iranian people. The people will eventually reach their threshold and this regime, weakened by powerful sanctions and escalating isolation, no longer has the capacity to confront the protesting Iranian people.

A storm is coming, to say the least.

Shabtabnews In this dark night, I have lost my way – Arise from a corner, oh you the star of guidance.

Shabtabnews In this dark night, I have lost my way – Arise from a corner, oh you the star of guidance.